Digital Audio Streaming Platforms

by Anna Fleck,

Sep 30, 2024

Digital audio streaming has taken off in a big way in the past ten years. According to Statista’s Digital Music Outlook, the music streaming market size increased to US$25.84 billion in 2023, reaching a total of around 900 million users.

The pandemic years saw particular growth in the podcast industry, as people forced to stay home searched out entertainment, driving up listenership and advertiser investment. According to Megaphone, a podcast technology company owned by Spotify, where 2021 was a story of “content explosion”, 2022 became one of “diversification”, as the most significant jumps in podcast downloads came from markets newer to the medium, such as Spain (+298 percent), Italy (+244 percent), and France (+375 percent), while the highest growth in unique listeners in terms of age groups was the 13-17 year olds (+49 percent) and the 55-64 year olds (+45 percent).

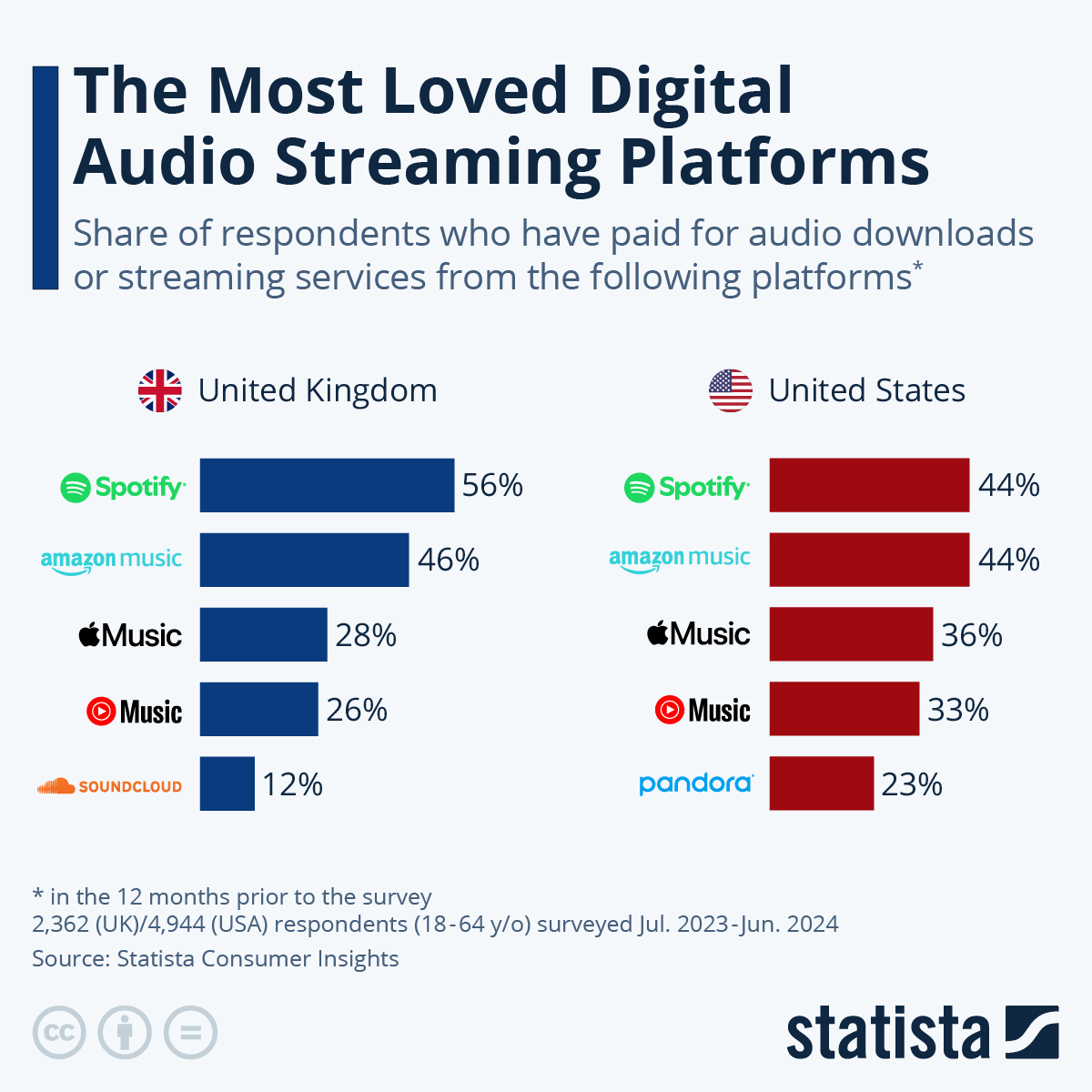

A handful of companies are leading the way in this era of digital audio content. Survey data from Statista’s Consumer Insights shows that in the United States, Spotify, originally a startup from Sweden, has gained popularity in recent years and now matches U.S. homegrown Amazon Music as the most widely used streaming service in the country. In both cases, more than four in ten respondents that had purchased music streaming services in the past 12 months said they had used the platform. In this chart, both music and podcasts are grouped together.

In the United Kingdom, Spotify reigns king. Apple Music and YouTube Music are also popular options in both countries, while the lower ranking platforms start to diverge more; in the UK, Soundcloud is in fifth position at 12 percent, followed by Deezer in sixth position (10 percent) and eMusic (6 percent) in seventh, while in the U.S., these places are filled by Pandora (23 percent), iHeartRadio (18 percent) and Sirius XM (14 percent).

Looking to the future, Statista’s analysts explain: “The disruptive impact of music streaming services such as Spotify or Apple Music has not only won the fight against illegal distribution, but also broken down all barriers and made access to all kinds of music as easy as ever. In order to stand out, however, many service providers are now starting to counteract this trend by focusing on exclusivity, e.g., pre-releasing new music or offering unique content such as concerts or podcasts.”

You will find more infographics at Statista

You will find more infographics at StatistaAccording to IFPI’s Global Music Report, worldwide recorded music revenues totaled $26.2 billion in 2022, up 9 percent from the previous year’s total of $24 billion. This marks the eighth consecutive year of growth for the global music industry after nearly two decades of gradual decline.

Interestingly, the transition to digital distribution has both fueled the music industry’s decline and helped stop it. After the golden age of the CD, which propelled worldwide music revenues to unprecedented highs through the 1990s, the advent of MP3 and filesharing hit the music industry like an earthquake. Between 2001 and 2010, physical music sales declined by more than 60 percent, wiping out $14 billion in annual revenue. During the same period, digital music sales, mostly downloads a the time, grew from zero to almost $4 billion, which wasn’t even remotely enough to offset the drop in CD sales. It wasn’t until the appearance and widespread adoption of music streaming services that the music industry’s fortunes began turning around again.

According to data published by IFPI, the music industry bottomed out in 2014, when revenue was at a 20-year low of $13.1 billion, $9 billion less than it had been 15 years prior, when physical music sales alone had amounted to $22.3 billion at the peak of the CD era. After some initial hesitancy by the music industry to embrace streaming services, record labels and artists appear to have followed consumers’ lead in accepting that the future of music lies in digital distribution. In 2022, digital music accounted for the lion's share of worldwide music revenues, with streaming services alone accounting for 67 percent of the industry’s total haul. According to IFPI, 589 million people were using a paid music streaming subscription by the end of 2022 and streaming revenues are now considerably bigger than digital download sales ever were.