The Plant Based Milk Boom

Asia Leads the Plant Based Milk Boom

by Anna Fleck,

Aug 21, 2024

Asia is the global trailblazer of plant milk substitutes. According to data from Statista’s Market Insights, the region was estimated to pull in a revenue of $13.4 billion in 2023. This was mostly led by China, which had an estimated revenue of $9.5 billion that year alone. Other major markets in Asia included Japan ($1.8 billion), South Korea ($0.4 billion) and India ($0.4 billion).

You will find more infographics at Statista

You will find more infographics at StatistaFollowing some way behind is North America, with the United States as the region’s major market ($3.6 billion). Europe places in third position in the regional ranking, with an estimated revenue of $3.9 billion in 2023. There, the major players were Germany ($0.8 billion), the United Kingdom ($0.6 billion) and Spain ($0.6 billion). The regional markets in South America and Africa were substantially lower in 2023, at $0.7 billion and $0.2 billion, respectively.

According to Statista analysts, the milk substitutes market will continue to expand in the coming years, reaching a global revenue of over $35 billion by 2028. While Asia will remain the market with the biggest revenue due to its sheer population size, Europe and North America will see steeper growth in terms of average revenue per capita, as milk substitutes continue to gain popularity in both regions.

Substitute milks perform differently in each market. For example, in China, soy drinks are traditionally the most popular of the plant-based milks due to a tradition of soy consumption and the plant’s availability, according to Mordor Intelligence. In Sweden, the hometurf of brand Oatly, oat milk is particularly popular, while in the United States, almond milk is the most sold plant milk.

by Felix Richter,

Aug 21, 2024

Celebrated annually on August 22, World Plant Milk Day was established in 2017 by Robbie Lockie, co-founder of Plant Based News, to raise awareness about the environmental and health benefits of choosing plant-based milk alternatives over dairy milk. It encourages people to explore the variety of plant-based options, such as almond, soy, oat and rice milk, which are easier digestible for many people, especially those who are lactose intolerant, and have a lower environmental impact. Ultimately, the day is part of a broader movement aiming to promote a shift towards more sustainable and compassionate food choices.

Cow's milk has a significant environmental footprint, primarily due to the methane produced by cows, a potent greenhouse gas. Additionally, dairy farming requires substantial land, water and energy resources, further adding to milk’s high carbon footprint. According to research conducted by Michael Clark et al. published in 2022, producing a liter of dairy milk results in about 3.7 kg of CO2 equivalent emissions.

Plant-based milk alternatives, such as almond, oat, soy and rice milk, have a much lower emissions footprint. According to Clark et al., these alternatives emit between 0.45 (oat milk) and 1.44 (rice milk) kilograms of CO2 equivalent per liter, making them far more sustainable. By choosing plant-based milks, consumers can significantly reduce their greenhouse gas emissions, contributing to climate change mitigation and a smaller environmental impact of food consumption.

You will find more infographics at Statista

You will find more infographics at Statistaby Katharina Buchholz,

Aug 22, 2023

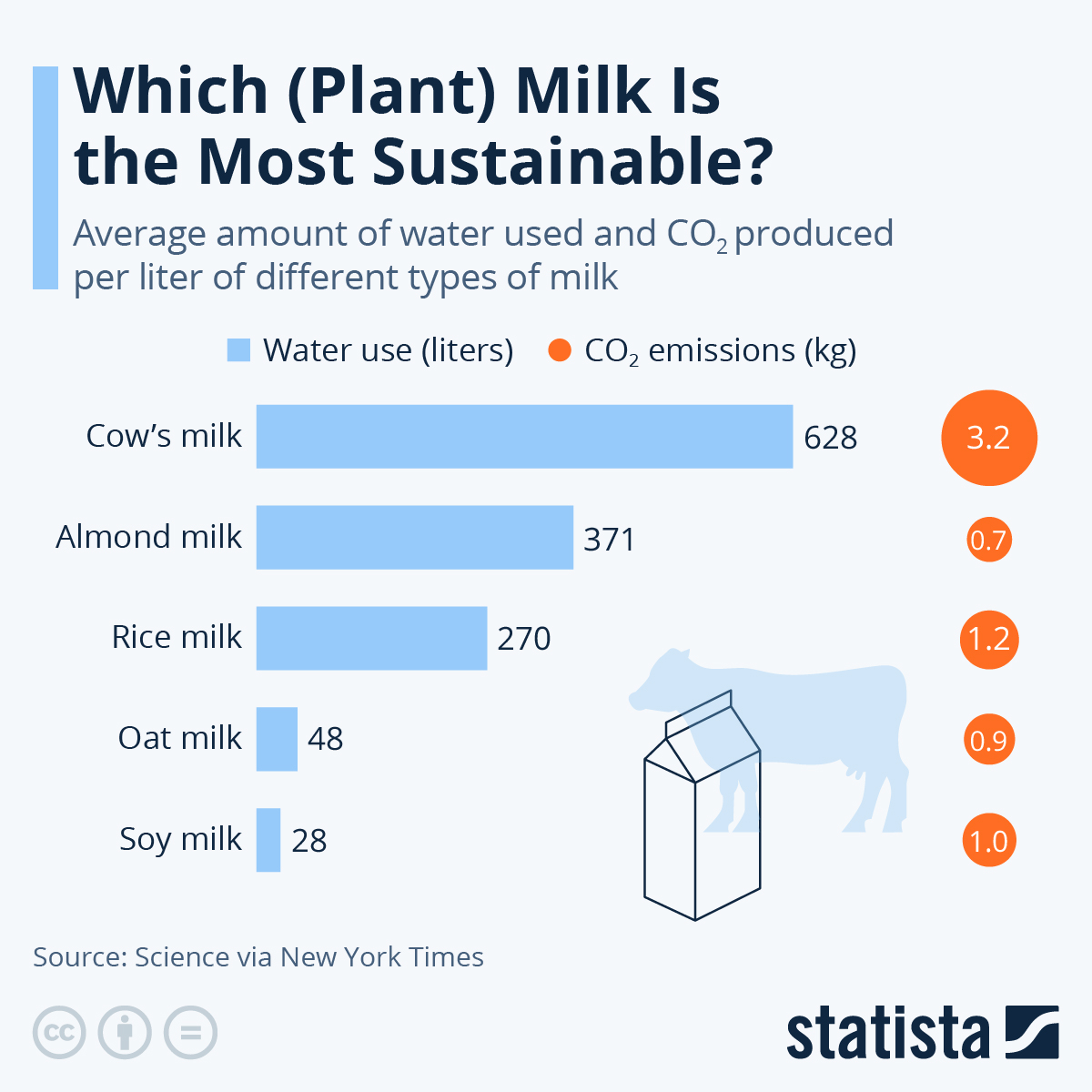

It comes as no surprise that among milk options, cow's milk is the least sustainable in terms of the carbon dioxide emissions and water consumption associated with its production. But the sustainability of plant milks also varies, as seen in a comparison by Science magazine and The New York Times.

Every liter of cow’s milk produced uses up 628 liters of water and generates 3.2 kgs of CO₂. Even the most water hungry among the plant milks, almond milk, reaches only 60 percent of that water use and the biggest polluter among them, rice milk, causes not even 40 percent of the emissions generated by cow’s milk. Soy and oat milk are even more sustainable options when it comes to water use, only requiring a fraction of the water used in the production of cow’s milk.

Since the production of oat and soy milk is so light on the environment, packaging and transport actually becomes the bigger component, according to a report by the BBC. Depending on the location of the drinker, one of the two could be more likely to have been imported from a far-flung location, but its not always easy to find out where the products used in a specific plant milk originated. A common misconception is that soy milk (or soy for human consumption) contributes to the destruction of the Amazon rain forest. For the most part, Brazil grows soy for animal feed, while soy used in tofu and plant milk predominantly come from Europe, North America and China.

You will find more infographics at Statista

You will find more infographics at Statistaby Florian Zandt,

Aug 21, 2024

Plant-based alternatives to food products derived from animals have increased in popularity in recent years, with substitutes for milk generating the highest revenues worldwide. According to the Good Food Institute's (GFI) 2023 State of the Industry Report, worldwide revenues from plant-based alternatives stood at $29 billion in 2023. Soy, oat, almond or other milk alternatives brought in $19 billion, almost half of which was generated in the APAC region.

This trend is also reflected in a recent Statista Consumer Insights survey conducted in 52 countries worldwide. Of all countries analyzed, India had the highest share of respondents regularly consuming dairy-substitute products with 32 percent, followed by Thailand and the United Arab Emirates with 29 percent. Other Asian countries and regions in the top 8 are China and Hong Kong.

The global average was 20 percent, with Japan, Serbia (11 percent each) and Argentina (10 percent) at the bottom. Important to note: The questionnaire did not differentiate between milk, yogurt or cheese substitutes. Other data suggests that the latter two play a negligible role in terms of the commercial aspect of plant-based alternatives.

While alternatives to dairy products, especially soy, almond or oat milk, have become widely available in supermarkets around the world, revenues are significantly lower than those of milk products derived from animals. In the U.S. alone, sales of refrigerated milk in stores generated around $14.1 billion in 2023, while plant-based milk revenue stood at $2.5 billion, according to Circana's 2024 Dairy and Plant-Based Trends & Expectations report.

You will find more infographics at Statista

You will find more infographics at Statista